TrustLayer is an all-in-one COI tracking, collaboration, and automation platform that increases accountability and trust with your partners.

Begin by signing up, and within 24 hours, you'll receive a Kick Off email to guide you through the process

Submit your data within the first 90 days to prompt the assignment of your Implementation Manager, who will be there to assist you throughout the next steps.

Schedule a Discovery/Data Review Call to kickstart your 60-day Implementation phase, gaining direct access to your Manager for setup, workflow creation, and comprehensive platform training.

Manage and collect risk documents and manage decision points across all of your vendors and projects.

Easily ensure vendors are compliant before issuing payment.

Get total risk visibility and understand where your business partners sit. Turning risk management into a profit center.

Your day-to-day system for automated collection, follow-ups, and communication with your teams and business partners.

Brokers use TrustLayer to advocate for their clients and get their job done better and faster.

Collecting, tracking, and verifying certificates of insurance is an extremely time-consuming and manual task.

Also, insurance can be really complex.

Small mistakes can result in increased workers compensation risk with huge financial losses for unprepared firms.

With TrustLayer, companies can minimize or eliminate this risk with automated verified insurance documents on file before an injury occurs.

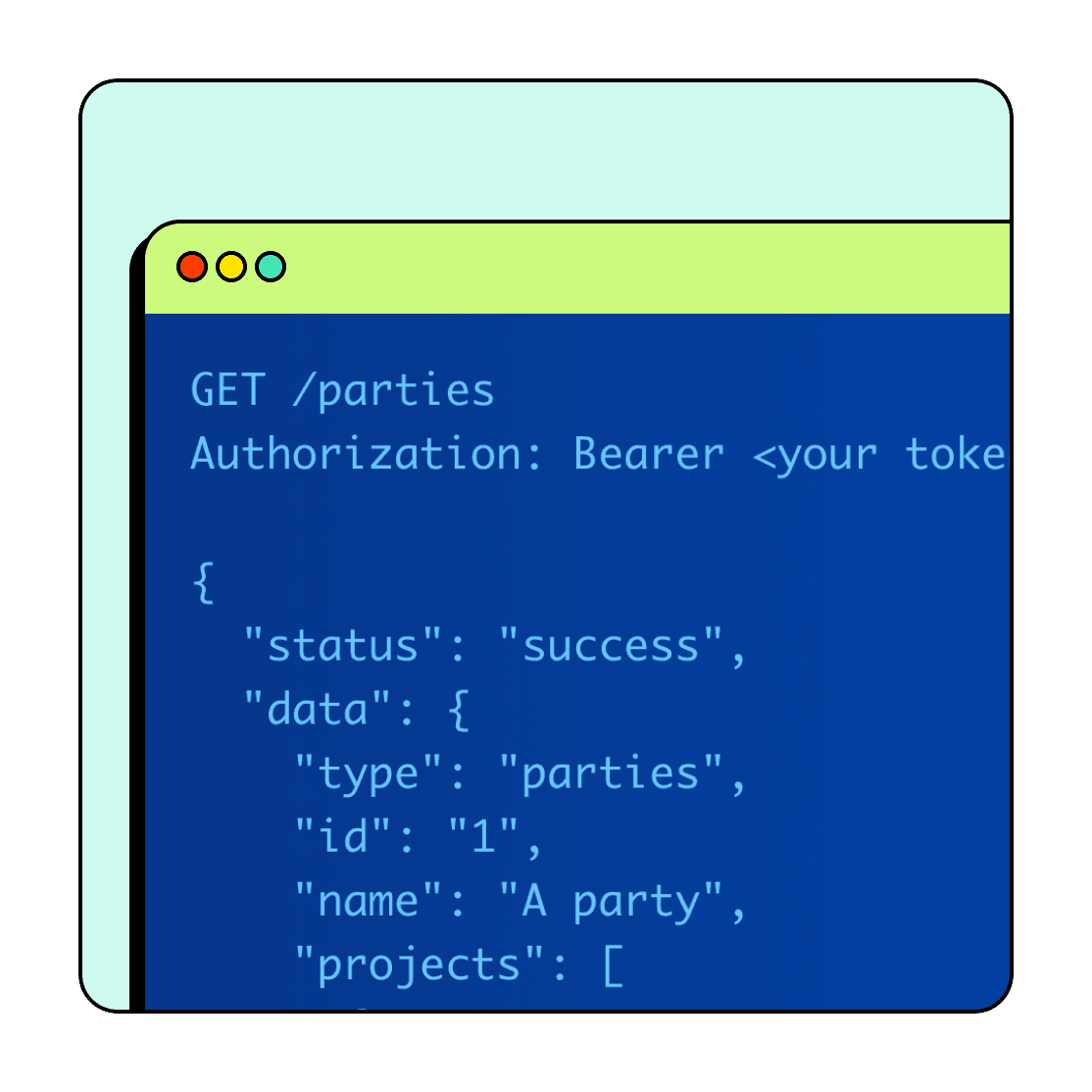

The TrustLayer Platform API allows for you to connect your data through external applications – from here you’ll be able to work with data stored and transact your account. Access your compliance profiles, parties, projects, doucments, and more – all sent via a simple JSON payload.

Discover the importance of a Certificate of Insurance (COI) and its role in protecting your business. Learn more in our informative article.

Discover the drawbacks of manual Certificate of Insurance (COI) tracking. Learn why automated solutions are crucial. Stay compliant effortlessly.

Optimize compliance & transparency with COI tracking software. Streamline management, reduce risks, and enhance accountability. Learn more.

Speed and Efficiency: Our software is designed with your client's time in mind. They can collect, verify, and manage vendor documents, like COIs, faster than ever.

Precision they Can Rely On: Say goodbye to errors and oversights. TrustLayer ensures each document is meticulously verified, giving your client's peace of mind.

Scale with Ease: Whether they're dealing with ten vendors or a thousand, our platform scales to your client's needs, ensuring smooth document management.

User-Friendly Interface: No more cumbersome processes. TrustLayer's intuitive design means your client's spend less time learning and more time doing.

Secure and Compliant: We prioritize the security of your client's data. Our advanced encryption and compliance standards protect their documents at every step.

Connect with TrustLayer and join the fastest growing network built with the industry to solve digital proof of insurance.

“Partnership with TrustLayer is a win-win on both sides – it’s solving a need for our clients, and it’s also giving us additional areas to go after additional revenue. We use TrustLayer as a tool to help bring insurance certificate compliance solutions to our current clients to retain our business, and then we use it as a way to get into new businesses.”

Director Of Operations Ansay & Associates